When I left my job to start my business, I knew there was one thing I had to get right: the finances. We often become so wrapped up in how to keep money coming in that we don’t pause to think about how we actually manage that money.

Just as with our personal finances, our business finances require careful management. We need to save for future equipment costs, for the rainy day we hope will never come, and for taxes.

And above all, we need our business to actually make us some money! The saying goes that an entrepreneur will work 60 hours a week to avoid working 40 hours for someone else, but the truth is, it’s not just the freedom of not having a boss that attracts us to this life, it’s the freedom of being able to make more money.

That’s why Profit First has been essential.

What is Profit First?

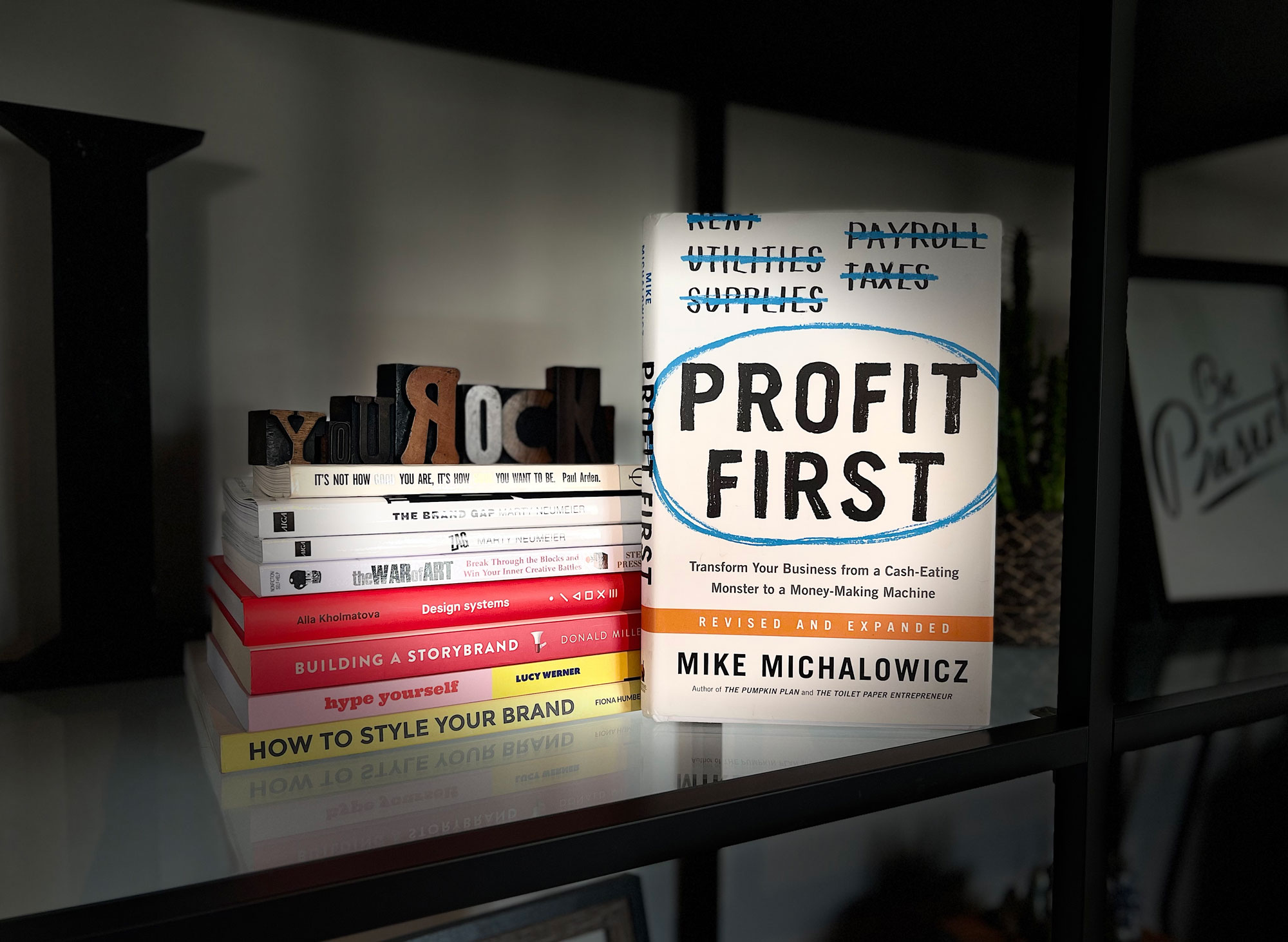

Profit First is a book and method by Mike Michalowicz, Profit First is about taking your profit first (like the pay-yourself-first method of personal budgeting) so you will always turn a profit. Of course, it is both this simple and not this simple in practice.

Profit First turns the traditional accounting model on its head. Instead of:

Income – Expenses = Profit

Profit First challenges you to look at it like this:

Income – Profit = Expenses

In other words, you don’t spend more than you can afford to without eating into your desired profit.

It stops you from calculating profit later and puts it as a priority.

Mike recommends that you not only take your profit first but use an envelope system for budgeting for your business so the profit you take is never eaten by the business. Mike recommends using the following different bank accounts to do this:

- INCOME: A main account, in which all incoming money is fed into

- OWNER’S COMPENSATION: The money you get for your salary

- TAX: To pay the tax you owe

- OPERATING EXPENSES: the account all your expenses are paid from

- PROFIT: Where you hold your profit

For some businesses, he also recommends additional accounts:

- PAYROLL: where employee pay is held (this is also useful for those who outsource or use contractors)

- VAULT: a rainy day fund

Why does Profit First matter?

When I was freelancing on the side of my full-time job, I had no idea what my profit was. I had no idea how much to put aside for tax and long-term expenses. Like so many freelancers and business owners, tax time was a source of stress for me, as I just hoped I had the money to pay what I owed.

Fortunately, that’s not the way it has to be. When you implement Profit First, you have plenty put aside for expenses like these, and even have money left over to give yourself a bonus.

How to Implement Profit First

First, Actually Look at Your Finances

You’d think that running a business would make paying attention to your financial information essential. And it does – but you may be surprised (or not!) to find out that freelancers and business owners can go around with the same blinkers on as everyone else, and do everything but look at their financial health.

Income and profit are not the same thing. Huge revenue numbers won’t make your business a success alone. After all, if you aren’t profitable, are you really successful? As Mike reveals in his book, even large businesses can leave the owner struggling to pay their bills. In other words, the business appears as a success, but it isn’t really healthy.

So, you need to know where you stand. Do you have any savings? Are you starting from zero? Does the thought of getting real about your business’s financial health spark panic? If so, all the more reason to take this step. Look at it all.

Next, Open the Necessary Bank Accounts

One of the most difficult aspects of implementing Profit First for many businesses is the fact that Mike recommends an envelope system to keep your money in different places. While this is a great idea, doing this with traditional banks is almost impossible – there are very few that allow the average small business to have that many separate accounts.

Fortunately, modern online banks have come along to save the day with an envelope system built into their accounts. I use Monzo, which offers Pots, but I believe Starling offers something similar.

I divide my accounts into six pots:

- Main Account (Income/Revenue)

- Tax Pot (Monzo Business Premium automatically takes a percentage of all income and put it in this pot – you can set the percentage)

- Profit Pot

- Owner’s Compensation (my salary)

- Operating Costs + Expenses

- Vault (my rainy day fund)

Set Your Target Allocation Percentages (TAPs)

To best do this, I recommend you read Profit First for all the information you need to set realistic allocation percentages.

For most small businesses, Mike recommends the following breakdown for the 5 main accounts:

- Main Account, which gets 100% of the money that comes in, which then feeds into…

- 5% into profit (start with as little as 1% if you need to)

- 50% into owner’s pay

- 15% into tax

- 30% into operating expenses

Clearly, you’ll need to tweak these numbers to suit your business and any additional accounts you need. Again, read Profit First for more help here.

For a little bit more insight, here’s my breakdown:

- Main Account, which gets 100% of the money that comes in, which then feeds into…

- 15% into profit

- 55% into owner’s pay

- 30% into tax – this is automatically taken out by Monzo before the rest is divided

- 25% into operating expenses

- 5% to Vault (my rainy day fund)

Move the Money (and Don’t Cheat!)

Finally, you actually have to implement the system, and this requires a little bit of discipline. Mike recommends dealing with your money around twice a month, but you may need to do so more often in the beginning. There’s a great cheat sheet here (page 2 + 3) which you can use to see the timing Mike recommends for managing your money.

You can’t cheat and keep moving money around. If you need to, it’s a sign that something is off. You have too many expenses, or your allocation percentages are off. You need to be disciplined and work with what you have available. If you need more money coming in, think about ways to raise that money from your clients. Can you offer something else, or can you increase your prices?

This isn’t always easy, especially if you’re working on tight profit margins, but you really have two options:

- Stay ignorant and hope you accidentally become profitable (hint: it doesn’t work this way!)

- Open your eyes, look at what you’re actually working with, and make changes to ensure you maximise profitability.

Optional (But IMHO Essential) Next Step: Find Profit-First Aware Professionals

You can implement Profit First in your business without ever talking to a bookkeeper or an accountant, but if you intend to work with a bookkeeper and/or accountant, you’ll find your life gets much easier if they are familiar with Profit First. You can find Profit First Professionals all around the world, and my accountant, Lagom Finance, has been more than happy to work with me on this. If you’re looking for a modern, profit-focused accountant, you can find out more about their services here.

Using Profit First has brought me such a great sense of security that I recommend this book to everyone I know who owns their own business. If you haven’t read Profit First yet, again, I recommend you do. Mike writes in an incredibly accessible way and, if you prefer, grab the audiobook for an illuminating and entertaining read. You can find the book here.